Brokers, Insurers & Underwriters for Campervans Explained

Last Reviewed - 14/10/2025

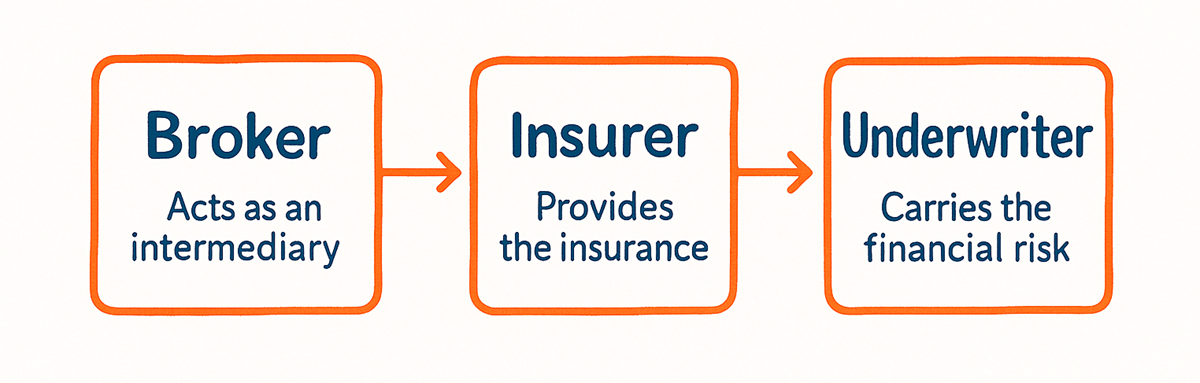

This guide explains the difference between brokers, insurers and underwriters, and how those roles can affect your price, wording, and claims experience.

Understanding who really covers your campervan and why it matters.

If you’ve ever tried to make sense of who actually insures your campervan, you’re not alone. Between brokers, insurers, and underwriters, the process can feel deliberately complicated. This page breaks down what each of them does, how they work together, and why it’s especially relevant for campervan owners.

Table of contents

- Understanding who really covers your campervan and why it matters.

- Why it can be confusing

- 1. The Three Key Roles

- Broker vs Insurer vs Underwriter: quick comparison

- 2. How This Affects Campervan Owners.

- 3. Pricing & Complaints

- 4. Regulation & Trust.

- 5. Summary Table

- 6. FAQs - Brokers, Insurers and Underwriters (Campervans)

- 7. Key Takeaways

Why it can be confusing

When you buy a campervan policy, you’re often dealing with a broker rather than the insurer itself. The broker gives you a quote, takes your payment, and sends your policy documents. But when something goes wrong, like making a claim, it’s the underwriter who pays out.

Understanding this chain matters because it affects everything from your renewal price to how your claim is handled.

1. The Three Key Roles

Insurance Broker

A broker acts as your go-between. They don’t actually insure you, instead, they help match your needs to an insurer’s product. Brokers often work with several underwriters, each offering slightly different pricing or terms.

For campervan owners, brokers are vital because mainstream insurers often won’t touch modified or self-build vans. Specialist brokers understand your setup, whether you’ve added a pop-top, solar panels, or custom storage.

As one industry source put it, brokers “serve the customer,” while underwriters “serve the insurance company.” In other words, the broker’s job is to get you the most suitable policy, not necessarily the cheapest, but one that fits how you actually use your van.

Insurance Underwriter

The underwriter is the company that takes on the financial risk. They set the terms, calculate the premium, and decide whether to approve your claim. You’ll usually see their name in your documents under the phrase “Underwritten by…”

They’re the ones ultimately responsible for paying out if you have an accident or loss. Even if you buy your cover through a broker like Brentacre or Towergate, it’s the underwriter behind the scenes who decides whether a claim is valid.

Insurance Company / Provider

The insurer or provider can sometimes act as both the broker and the underwriter. Big names like LV or Aviva do this. But in the specialist vehicle market, most “insurance providers” are technically brokers who sell policies underwritten by larger insurance companies.

Broker vs Insurer vs Underwriter: quick comparison

| What matters | Broker | Insurer | Underwriter |

|---|---|---|---|

| Advises you & searches the market | ✓ | ◐ | ✕ |

| Creates product & sets wording | ✕ | ✓ | ✓ |

| Holds the risk & pays valid claims | ✕ | ✓ | ✓ |

| Access to multiple underwriters | ✓ | ✕ | ✕ |

| Primary contact for quotes & changes | ✓ | ◐ | ✕ |

| Decides claim outcome | ✕ | ✓ | ✓ |

| Best route for complex self-builds | ✓ | ◐ | ◐ |

| Typical complaints owner* | ◐ | ✓ | ✓ |

Legend: ✓ Included · ◐ Depends · ✕ Not included

*Service/admin issues → broker. Policy wording, decisions and payouts → insurer/underwriter.*

Details vary by product; always check your documents for “Underwritten by …”.

It’s one reason why the same van, with the same underwriter, can cost different amounts depending on which broker you buy through.

2. How This Affects Campervan Owners.

Brokers dominate the campervan insurance market because most insurers don’t want the risk of modified or self-built vehicles. According to the Financial Conduct Authority (FCA), about two-thirds of UK insurance policies are sold through brokers or agents and that figure is even higher for specialist vehicles.

In real-world terms, forum users have reported price differences of several hundred pounds between brokers, even when the underlying underwriter is the same. That’s because each broker negotiates its own commission and pricing model.

For owners, the advantage of using a broker is flexibility. They’ll often allow you to declare and update modifications easily. Direct insurers are usually cheaper for standard factory vans, but less understanding when it comes to conversions or non-standard features.

3. Pricing & Complaints

Because brokers act as middlemen, their commission is included in your premium. It’s not a hidden fee, but it does mean a brokered policy can sometimes cost more upfront than buying direct. The trade-off is expertise and better access to tailored cover.

When it comes to complaints, the Financial Ombudsman typically rules against the insurer (or underwriter), not the broker, because they’re the ones holding the policy and paying out claims.

That said, brokers are responsible for giving fair, accurate advice and the FCA has tightened the rules around how they explain products and handle renewals.

In late 2024, more than 20,000 general insurance complaints were raised in the UK. The largest volumes came from big direct insurers, while specialist brokers saw relatively few. It’s one of the reasons small, focused firms like Brentacre often attract loyal customers.

Brokers are usually easier to reach and tend to give more personal support.

4. Regulation & Trust.

In 2025, the FCA announced plans to simplify and modernise the UK insurance rulebook. The goal is to remove outdated duplication and make responsibilities clearer between brokers, insurers, and underwriters.

As FCA Director Matt Brewis said, the regulator wants to “strip back unnecessary rules” so the industry can focus on fair pricing and transparency.

For consumers, this means clearer wording in policy documents, fewer hidden conditions, and hopefully, simpler routes to resolve disputes if something goes wrong.

5. Summary Table

| Role | What They Do | Who They Work For | When You Deal With Them |

|---|---|---|---|

| Broker | Finds and sells policies, advises on cover, handles admin | You (the customer) | When you buy, renew, or update your policy |

| Underwriter | Assesses risk, sets terms, and pays out valid claims | The insurer/company | When you make a claim or need policy approval |

| Insurance Company / Provider | Creates and sells the actual products; may also act as broker or underwriter | Both | Throughout your policy life, depending on structure |

6. FAQs - Brokers, Insurers and Underwriters (Campervans)

These FAQs are based on the most common questions UK campervan owners ask in forums and community threads, plus what brokers and underwriters tell us matters at quote and claim time. They focus on real-world issues: who to call, what affects price, self-build cover, DVLA status, NCD, and paperwork that catches people out. If we’ve missed your question, please send it to us and we’ll probably add it.

7. Key Takeaways

If you ever need to chase a claim, start with your broker, but remember the final decision sits with the underwriter.